|

So the question we are discussing today is - in

terms of the road to economic recovery, “Are we

there yet?”

As it’s turned out, while the average Australian’s

wealth is not yet back at the highs of before the

Global Financial Crisis, the threat of imminent

financial disaster has passed for most, the wealthy

are back to spending extra, and surely we’re all

back on the way to a comfortable retirement, in this

lucky country?

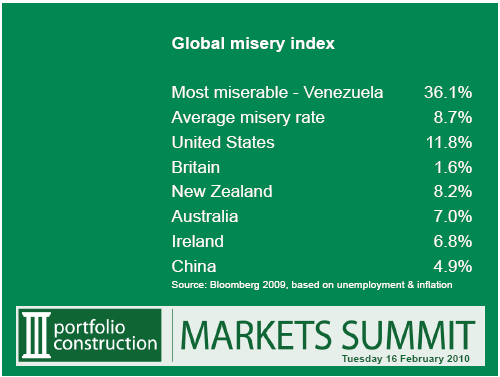

In terms of Bloomberg’s Global Misery Index (below) Australian’s were less miserable

last year than in 2008 (as were New Zealanders!).

For the record, Malaysians are the least miserable,

Americans and Brits feel worse than they did a year

ago, as do all of the G8. Of course, we didn’t even

have to experience a recession.

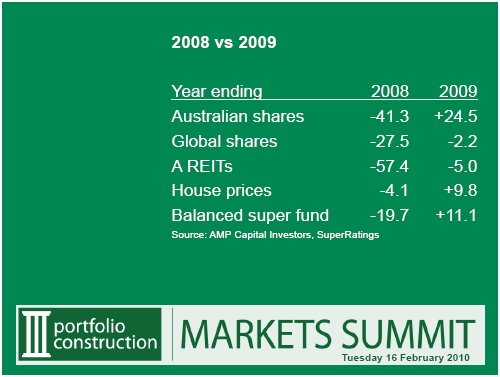

Yes, the 2009 gains should be viewed in the light of

2008 losses...

... but, surely, we can stamp the end of the first decade

of the new millennium as better than it looked like

it was going to be?

I wonder whether the good fortune we have at being

in Australia means that we not only missed a

recession, but we also missed the chance to think

deeply about the importance of different aspects of

economy that we are a part of?

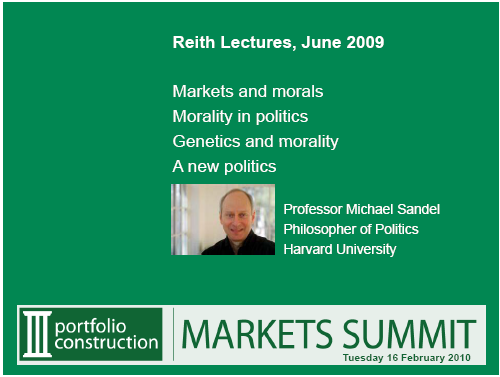

Harvard Professor Michael Sandel, political

philosopher, commented on the GFC aftermath by

saying...

[One of the lessons I’d like us to learn is that]

"Some of the good things in life are corrupted or

degraded if turned into commodities, so to decide

when to use markets, it’s not enough to think about

efficiency; we have also to decide how to value the

goods in question. Health, education, national

defence, criminal justice, environmental protection

and so on - these are moral and political questions,

not merely economic ones. To decide them

democratically, we have to debate case by case the

moral meaning of these goods in the proper way of

valuing. This is the debate we didn’t have during

the age of market triumphalism. As a result, without

quite realising it, without ever deciding to do so,

we drifted from having a market economy to being a

market society. The hope for moral and civic renewal

depends on having that debate now. It is not a

debate that is likely to produce quick or easy

agreement. To argue about the right way of valuing

goods is to bring moral and even spiritual questions

into public discourse."

The Reith Lectures

Markets and morals >

Morality in politics >

Genetics and morality >

A new politics >

So, is it true that compared with the hope, optimism

and potential that greeted the new century, just ten

years ago, we have largely had a decade that wasted

the potential? My dad used to say... "the

graveyard’s full of people who had potential."

As a consequence of the enormous costs to the global

economy of the irrational exuberance which resulted

in the Tech Wreck, and of the War on Terror, (now

seemingly more like Borat's "War of Terror") - both

pretty much at the beginning of the decade - and the

GFC at the end of the decade, and everything else in

between, it seems like much of the potential we all

had ten years ago has been squandered. Pretty well

all the global stockmarkets other than a few

emerging markets, had a dismal decade. Money that

could and should have been deployed to beating world

hunger, beating world health problems,

reinvigorating world infrastructure, and dealing to

climate change issues was spent irretrievably on

wars on terror and on preventing total financial

meltdown.

Or, can we be satisfied with a past decade of

success? Take a look at the last decade from a

business point of view.

What kind of decade was it?

Business >

(Save the file to your

computer, unzip it and view in Windows Media

Player.)

When I look back on the past decade, it seems to me

that we have been unwitting travellers through an

historical inflection point of modern history... one

that has coincidentally coincided with the first

decade of the new millennium.

Central to the inflection point of the last decade

has been the now widespread recognition of the

dominant and interconnected roles of China and

America in the performance of global markets. One of

the key themes raised by Niall Fergusson during our

2009 PortfolioConstruction Conference, was Chimerica.

As we focus on the outlook for the markets, it's

relevant that we update ourselves on where we're at

with Chimerica.

Nouriel Roubini, the US NYU economics professor who

reliably predicted the sub-prime crisis in 2006,

says that the 2010 outlook and beyond for the US is

precarious to say the least. His view is that the US

economy "stands a 20 to 25% chance" of slipping back

into recession in the next 12 to 18 months - that

is, a double dip - but his more likely scenario is

that the US economy will wallow through the downturn

as demonstrated by several years of below trend

growth.

Consequently, China is stuck with its major debtor

having arguably suspect quality assets backing what

China has loaned over a trillion dollars in public

debt against - and yet, it is in the bizarre

situation of needing to purchase even more US

dollars and bonds to preserve the value of its

existing holdings. And of course, the US (and

Australia for that matter), is largely dependent on

the continuation of Chinese growth.

Only a generation ago, China had an insignificant

influence on the global economy and little influence

outside its borders. Today it’s economic and

geopolitical influence is almost ubiquitous. No

government, business or individual is immune from

China’s manufacturing, financing, investing and

politicising. Now, in the year of the tiger, China

is already the second largest economy in the world.

We can further consider whether China will

eventually replace the US as the global economy’s

rule-setter. In a new book "When China rules the

world", British scholar and author Martin Jacques

stats that if we think that China will be integrated

smoothly into a liberal, capitalist and democratic

world system, we are in for a big surprise. He warns

that China will construct a world order that will

look and be very different from what we have had so

far. Americans, Europeans and, indeed, Australians,

blithely assume that China will become more like us

as its economy develops and its population gets

richer. This is a mirage, Jacques argues.

The Chinese and their government are wedded to a

different concept of society and polity:

community-based rather than individualist, state

centric rather than liberal, authoritarian rather

than democratic. China has 2,000 years of history as

a distinct civilisation from which to draw strength.

It will not simply fold under Western values and

institutions, Jacques argues. For example, consider

the Copenhagen Climate Summit - China showed the

rest of the world that what it wants, it gets. It

did not want to curb human-caused carbon emissions

where the economic and political cost was too high

for its liking. Hence, China’s insistence on

"sovereignty" and "consensus" in the so-called

negotiations, and the Copenhagen Accord giving China

everything it wanted. The Chinese leader who started

the middle kingdom on its last 30 years of

unimaginable economic and political growth, Den

Xiaoping, set forth a so-called 24-character plan

for re-securing China’s place in the world. "Hide

our capacities and bide our time; be good at

maintaining a low profile; and never claim

leadership," the former Chinese leader said nearly

twenty years ago. Yet 2009 can be remembered

as the year China was central to helping the rest of

the world in the management of the GFC, tidied up

from hosting the Olympics, held its 60th

anniversary, prepared for the world expo, and

ensured that the Copenhagen accord went its way. In

other words, China displayed international political

clout to match its economic clout.

What we all need to do is to understand - and not

necessarily fear - is what it means for Australia to

be trading and living with a powerful China. (And

while China seems to be getting all the attention,

don’t think that India’s crucial role should be

overlooked! Or Brazil’s for that matter.)

So, with the backdrop of the consequence of the last

decade, and the current position of China and

America, let’s start thinking about the global

economies and the global debt and equities markets

more specifically.

To introduce the PortfolioConstruction Markets

Summit 2010, I refer you to a number of background

preparation resources:

1. The global economic outlook

-

1. What lies ahead in 2010, a Pain Report

special, presented by Jonathan Pain.

Paper >

-

A BBC World interview, conducted late December

2009, with three eminent economists, reviewing

2009 and looking forward to 2010.

Podcast >

-

"3 Perspectives on the 2007-2009 Global

Financial Crisis; Minskian, Austrian and New

Keynesian", a thesis by Nicholas Markowitz.

Paper >

2. Global risks - World Economic Forum Global Risks

2010

-

World Economic Forum Global Risks 2010

Video >

(Save the file to your

computer, unzip it and view in Windows Media

Player.)

-

World Economic Forum Global Risks 2010

Paper >

-

World Economic Forum Global Risks 2010

Interactive tool

>

3. The global equities market outlook

-

The outlook for equities in 2010 -

Longview Economics - recorded in late December

2009, by our colleague Chris Watling of Longview

Economics in London, this follows up from Chris'

presentation at PortfolioConstruction

Conference 2009.

Video >

-

Selloff or something more sinister? -

Since Longview presented its 2010 outlookfor

equities, the market

has in fact pulled back and moved into the

beginning of Phase II of this cyclical bull

market, as predicted.

Paper >

And of course, don't overlook the plethora of

presentations, podcasts and papers in the other four

areas of this Resources Kit!

|