Worry about valuations?… Yeah, a bit…

Michael Furey | Delta Research & Advisory | 27 April 2020

The biggest equity market in the world, often represented by the S&P 500 index, crashed pretty quickly from 24 February 2020, reaching its bottom on 23 March. This was a fall of around 34% in US Dollars. Since then, it has bounced back by around 25% in almost five weeks. It’s not a bad turnaround but, obviously, it’s not yet back to its precoronavirus crisis highs.

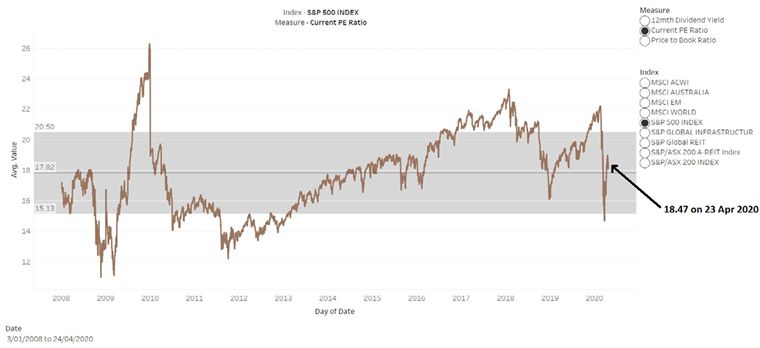

Figure 1 shows the PE Ratio of the S&P 500 back to early 2008 which was near the start of the Global Financial Crisis recession.

Figure 1: S&P 500 Index

Source: S&P 500, Delta Research & Advisory

I don’t know ab...